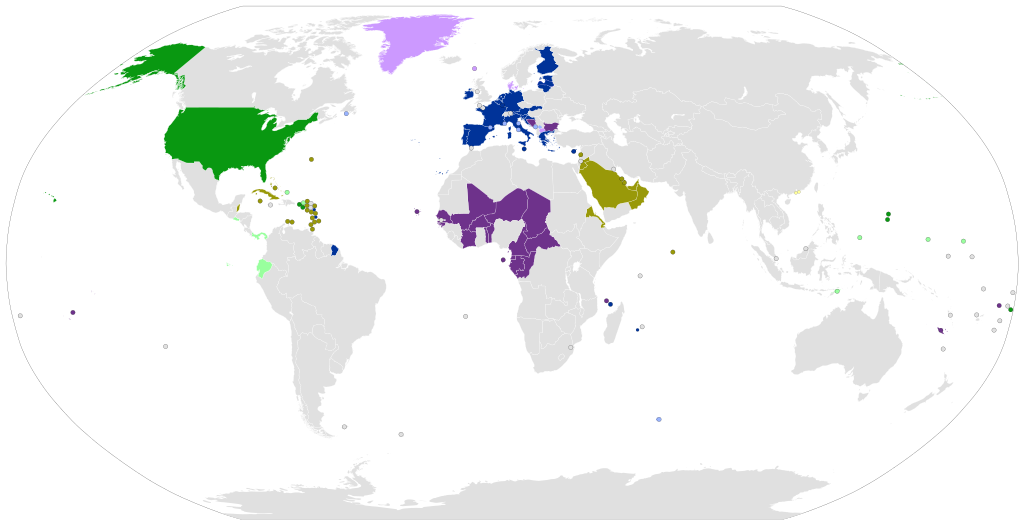

In the complex tapestry of global finance, the adoption of a single currency can reverberate far beyond its regional boundaries. The euro, long considered the backbone of the Eurozone, has increasingly become a focal point of interest for developing countries seeking stability and economic growth. In this analysis, we delve into the dynamics of how the euro’s influence is extending beyond the Eurozone, shaping economic landscapes in developing nations.

The adoption of the euro by developing countries is a strategic move, rooted in the desire for stability and reduced vulnerability to currency fluctuations. As these nations grapple with economic uncertainties and strive for global integration, the euro offers a haven of financial resilience. By aligning with a robust currency, these economies aim to fortify themselves against the inherent risks associated with volatile domestic currencies.

In recent years, an increasing number of developing countries have explored currency partnerships or pegging arrangements with the euro. The benefits extend beyond mere stability, with the euro serving as a gateway to enhanced trade relations and heightened credibility on the global stage. This move is a testament to the evolving role of the euro as a key player in the international monetary landscape.

The adoption of the euro by developing nations is not a mere financial transaction; it’s a strategic maneuver in the realm of economic diplomacy. For these countries, aligning with the euro is more than a hedging strategy—it’s a statement of intent. By embracing the euro, they signal to the international community their commitment to stability, fiscal responsibility, and a transparent economic environment.

According to renowned economist Dr. Emily Simmons, “The euro’s expanding influence in developing economies is emblematic of a shifting global economic order. As these nations recognize the strategic importance of aligning with a robust currency, the euro emerges as a natural choice, offering a blend of stability and international credibility.”

One of the primary drivers behind the adoption of the euro is the facilitation of international trade. Developing nations leveraging the euro benefit from reduced transaction costs and enhanced trade efficiency. The euro’s widespread acceptance in international trade transactions streamlines cross-border commerce, minimizing the risks associated with currency fluctuations and providing a platform for sustained economic growth.

Data from the International Monetary Fund (IMF) indicates a noticeable uptick in trade volumes for developing countries that have adopted the euro as a reference currency. This trend underscores the positive correlation between euro adoption and expanded global trade opportunities, fostering a mutually beneficial relationship between these nations and the Eurozone.

While the allure of the euro is evident, the path to adoption is not without challenges. Developing countries must navigate complex economic and political landscapes to integrate the euro into their financial systems successfully. Currency pegs and exchange rate regimes require careful calibration to ensure a harmonious transition and avoid unintended economic consequences.

Moreover, the potential impact on domestic industries, employment, and inflation necessitates a judicious approach. These challenges underscore the importance of meticulous planning, collaboration with international financial institutions, and a comprehensive understanding of the intricacies involved in adopting a new currency.

As the euro extends its influence into developing economies, the global economic landscape is witnessing a transformative shift. The strategic adoption of the euro by these nations reflects a nuanced understanding of the currency’s role beyond the Eurozone. It is not just a means of financial stability but a catalyst for enhanced trade, economic diplomacy, and global integration.

In the words of Christine Lagarde, former Managing Director of the International Monetary Fund, “The euro’s growing prominence in developing economies is a testament to the Eurozone’s economic resilience and the global recognition of the euro as a pillar of stability. The challenge now lies in fostering a collaborative approach to ensure a seamless integration that maximizes the benefits for all parties involved.”

As the euro’s ascent continues, developing countries must tread carefully, capitalizing on the opportunities it presents while navigating the complexities of economic transformation. The evolving relationship between the euro and developing economies is a dynamic chapter in the ongoing saga of global economic interdependence—one that demands a judicious blend of strategic foresight and meticulous execution.