Introduction:

In the fast-evolving landscape of global finance, a profound shift is occurring as investors increasingly turn their attention to sustainability investments, commonly referred to as “green investments.” This surge is not merely a trend but a fundamental reorientation of investment strategies, driven by a growing awareness of environmental, social, and governance (ESG) factors. In this analysis, we delve into the factors propelling this green wave, explore its implications for global financial markets, and assess the long-term sustainability of this investment approach.

The Rise of Green Investments:

The last decade has witnessed a seismic shift in investor sentiment, with a surge in demand for sustainable investments. According to the Global Sustainable Investment Alliance (GSIA), global sustainable investment assets reached $35.3 trillion in 2020, a 15% increase from 2018. This growth underscores a paradigm shift as investors increasingly align their portfolios with ethical, social, and environmental considerations.

Driving Forces:

Several factors are propelling the green investment wave. First and foremost is the heightened awareness of climate change and its far-reaching consequences. Investors are recognizing that companies with robust ESG practices are better positioned to weather the storms of regulatory changes and market disruptions.

Government policies also play a pivotal role in shaping investor behavior. The global push towards carbon neutrality, as seen in the Paris Agreement and various national commitments, is fostering an environment conducive to green investments. In the United States, for instance, the Biden administration’s focus on clean energy and infrastructure has injected fresh vigor into the renewable energy sector, attracting a wave of investments.

Furthermore, investor demographics are evolving. The younger generation of investors, driven by a heightened sense of social responsibility, is pushing for sustainable investment options. A 2021 survey by Morgan Stanley found that 95% of millennials are interested in sustainable investing, and 85% believe their investments can influence climate change.

Expert Perspectives:

To gain deeper insights into this growing phenomenon, we spoke with Sarah Johnson, a leading ESG analyst at Sustainable Investment Strategies, who noted, “Investors are no longer viewing sustainability as a niche segment. It has become a critical lens through which to evaluate the resilience and longevity of an investment. Companies with robust ESG practices are not only mitigating risks but are also better positioned to capitalize on emerging opportunities in the transition to a low-carbon economy.”

Implications for Global Financial Markets:

The increasing prominence of green investments carries multifaceted implications for global financial markets. One notable impact is the reallocation of capital. Traditional industries with higher carbon footprints may face capital flight as investors redirect funds toward sustainable alternatives. This shift is prompting companies to reassess their ESG practices to attract and retain investor interest.

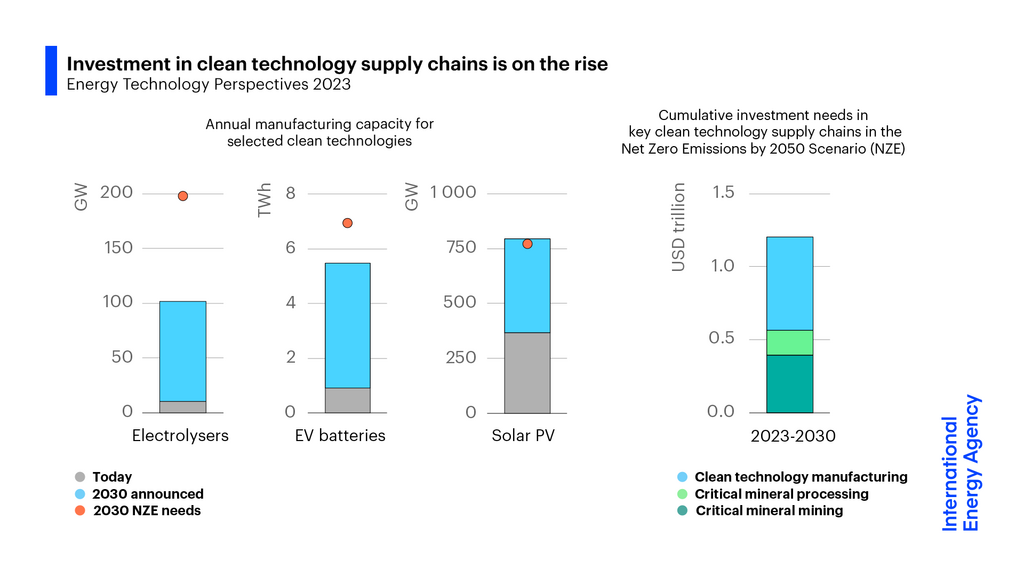

Another consequence is the emergence of new investment opportunities. The renewable energy sector, electric vehicles, and sustainable agriculture are witnessing a surge in funding, creating a ripple effect throughout associated supply chains. As these industries flourish, they contribute to job creation and economic growth, further reinforcing the virtuous cycle of sustainability.

However, challenges persist. The lack of standardized ESG metrics and reporting frameworks hinders comparability and transparency. Investors are calling for unified standards to assess and benchmark companies’ sustainability performance accurately.

Long-Term Viability:

While the green investment wave is gaining momentum, questions about its long-term viability linger. Some critics argue that the focus on sustainability may come at the expense of financial returns. However, a growing body of evidence suggests that companies with strong ESG performance often outperform their peers over the long term.

A study by Harvard Business Review found that companies with high ESG scores exhibited superior stock price performance and profitability compared to those with lower scores. This counters the traditional notion that sustainability compromises financial returns, indicating that the integration of ESG considerations can be a source of competitive advantage.

Conclusion:

As the green investment wave sweeps across global financial markets, it is evident that sustainability is no longer a mere buzzword but a fundamental consideration in investment decisions. The confluence of environmental consciousness, regulatory support, and shifting demographics is reshaping the investment landscape. While challenges persist, the long-term viability of green investments seems promising, providing a beacon for investors navigating an increasingly complex and interconnected world. The journey towards a more sustainable future is not just an ethical imperative but a strategic investment choice that resonates with the financial acumen of the savvy investor.

Photo credit: International Energy Agency, CC BY 4.0 <https://creativecommons.org/licenses/by/4.0>, via Wikimedia Commons